In today’s rapidly evolving technology environment, virtual currency such as Bitcoin is becoming more and more popular

What are digital currencies, you may ask?

Digital currency is essentially digital money that represents physical cash. While it may sound straightforward, it is more intricate than that. In the next few paragraphs, you will learn about the mechanics behind digital currency, why it is needed, and how it operates. Cryptocurrency, like Bitcoin, is a form of electronic currency. Cryptocurrencies work by using a complicated mix of secret keys, which are made up of letters and numbers, spread across a public ledger. This particular mix of secret keys guarantees that no fake Bitcoins can be produced, and since the ledger is public, any potential hacks are swiftly detected. This level of security exceeds other currency models, and as an investment tool, it makes virtual currencies more appealing. Everyone knows exactly how many Bitcoins exist, and is able to find out the details of every transaction.

Virtual currency such as Bitcoin works in the following way:

Party A transfers $x Bitcoins to Party B in exchange for a product

Bitcoins from Party A are assigned a unique transaction hexidecimal code, linking them to both Party A and Party B

Makes you the sole owner of a secure decentralize registry

Makes you the sole owner of a secure decentralize registry

Why?

Cryptocurrency is a type of digital money decentralized and using a shared ledger known as blockchain. Its nature has made it more and more popular in recent years as it lets people make secure and private transactions without involving a third party. Additionally, cryptocurrency is accessible worldwide, improving the efficiency and cost-effectiveness of sending and receiving payments. Cryptocurrency is a more secure payment method than traditional currencies because it is harder to fake and doesn’t fluctuate in value as much. Therefore, cryptocurrency is important for those who want to make safe and private payments and for those who want to make international payments without using a bank or other third party.

Mission

To enable anyone to use cryptocurrency, so individuals and businesses can send and receive payments without depending on traditional banks.

Objectives:

- Increase public knowledge and understanding of cryptocurrency.

- Develop secure and reliable software and infrastructure to enable cryptocurrency transactions.

- Foster strategic partnerships with organizations that can support the growth of cryptocurrency usage.

- Build a global network that allows users to access, store, and transact with digital currency quickly and safely.

- Create an ecosystem of services that utilize cryptocurrency to make payments easier and more efficient.

- Establish a robust regulatory framework to ensure the safety and security of cryptocurrency transactions.

- Create an open platform that allows developers to create new cryptocurrency applications.

- Develop innovative use cases for cryptocurrency to expand its use and utility.

How?

Cryptocurrency is a type of digital money that is produced and controlled by using sophisticated methods of encryption called cryptography. It is a currency that is not managed by a central authority such as a bank, but instead, it is created and maintained by a network of computers that utilize a distributed ledger technology known as a blockchain. Transactions made using cryptocurrency are secure, anonymous, and irreversible. Cryptocurrency can be used to purchase goods and services online, or to store value as an investment.

Problems

with global cryptocurrency market

The global cryptocurrency market has a major issue: it lacks regulatory oversight. Since there is no central authority regulating the market, it’s tough to determine who is trading and the amount of money exchanging hands. This lack of oversight may result in fraudulent activities, including price manipulation and pump and dump schemes.

Limited Acceptance:

Cryptocurrencies are not widely accepted by most merchants and businesses, so they cannot be used to buy goods and services in many locations. Cryptocurrencies are not widely accepted by most merchants and businesses, so they cannot be used to buy goods and services in many locations. This limits their usefulness.

Security Risks:

Cryptocurrencies rely on blockchain technology, which is new and untested. Therefore, there is a risk of security breaches and hacks, potentially resulting in the loss of funds.

Volatility:

Cryptocurrencies are very unstable, which means that their prices can change a lot in a short time. This makes them hard to predict and can cause investors who aren’t careful to suffer big losses.

Solutions

Cryptocurrency solutions aim to address trust and security concerns that surface when handling digital forms of money. They utilize cryptography to ensure secure transactions and safeguard users’ funds, thus guaranteeing safe transactions and money. Cryptocurrency solutions aspire to build a dependable and secure system that empowers users to transact digital money without intermediaries or third parties’ involvement. This may result in a financial system that is more democratic and decentralized, with greater control in the hands of users. Additionally, it could enable the enhancement of global payments in terms of efficiency, affordability, and security.

Cryptocurrency Payment Gateways:

Cryptocurrency payment gateways are digital systems that permit merchants to take payments in digital currencies such as Bitcoin, Ethereum, and Litecoin. They deliver a quick and safe way to send and receive payments. They are user-friendly and enable customers to pay with just one click. Additionally, they provide merchants with comprehensive analytics and reports to assist them in following their transactions. Some payment gateways also offer additional features such as fraud prevention and customer dispute resolution.

Safe and Secure:

Cryptocurrency is a digital currency that is exchanged using encryption to keep transactions safe and control the currency supply. To keep cryptocurrency safe, it’s important to secure the wallet, back up the private keys and passwords, use two-factor authentication, avoid scams, and never share private keys with others. Research the exchange and wallet you plan to use to make sure they are both trustworthy and secure.

Decentralize Payment Systems:

A decentralized payment system is a digital payment system that doesn’t need a central authority or a financial intermediary like a bank to help with transactions. Usually, these payments use distributed ledger technology, like a blockchain or a distributed ledger. Decentralized payment systems aim to be secure, fast, and efficient, with transactions taking place within minutes. Additionally, decentralized payment systems can provide cheaper costs and greater privacy in comparison to conventional payment methods since users do not have to share personal information with a third party.

How it works

Our Crypto-system based on blockchain and we solved issues of current and future

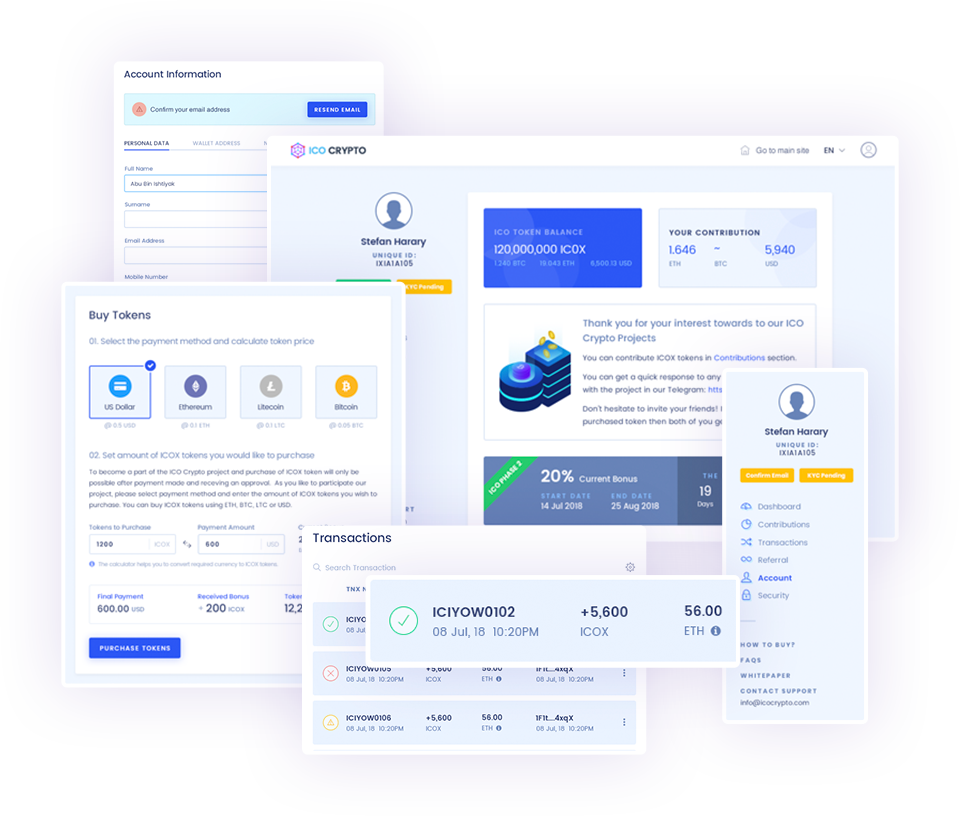

Introducing ICO Usercenter

ICO Usercenter is a platform that helps users access and manage their cryptocurrency investments. With ICO Usercenter, users can check how their investments are doing, research possible investments, and create investment portfolios. Users can also track how their investment portfolios perform over time and analyze new investment options. ICO Usercenter gives users access to different information and insights to support their investment choices.

How To Buy Cryptocurrency

If you’re new to cryptocurrency, buying Bitcoin, Dogecoin, Ethereum, Tether, Cardano, and other cryptocurrencies might be confusing. Don’t worry, it’s easy to learn. You can begin investing in cryptocurrency by following these five simple steps:

Step 1

Choose a Broker or Crypto Exchange

Step 2

Create and Verify Your Account

Step 3

Deposit Cash to Invest

Step 4

Place Your Cryptocurrency Order

Step 5

Select a Storage Method

FAQs

Below we’be provided answers about cryptocurrencies, blockchain and few others questions. If you have any other questions, please get in touch via email

ICO Crypto (Initial Coin Offering) is a type of crowdfunding activity in which a company or project raises funds by selling a predetermined number of digital coins (also known as tokens) to investors. The investors are usually rewarded with tokens, which can be used to access a company’s products or services. The sale of tokens is typically done via a blockchain platform, typically Ethereum

Most major cryptocurrencies such as Bitcoin, Ethereum, Litecoin, and Ripple can be used to purchase goods and services online. Additionally, some online retailers offer the option to purchase items with other cryptocurrencies, including Bitcoin Cash, Dash, and Monero

The ICO token sale can be participated in by following the instructions provided on the official website of the ICO project. Generally, these instructions include signing up for an online wallet, transferring funds from a personal wallet to an online wallet, and then purchasing the specified number of tokens

The primary benefit of blockchain is that it allows for secure, transparent, and immutable transactions. By utilizing blockchain technology, users can trust that the data stored and transferred on the blockchain is secure and accurate. Blockchain also offers individuals and businesses a secure platform to store, transfer, and manage data, eliminating the need for intermediaries like banks, lawyers, or government institutions. Additionally, blockchain-based networks are resistant to fraud and cyber-attacks, allowing users to trust in the validity of the information stored and transferred on the blockchain

Get In Touch

Any question? Reach out to us and we’ll get back to you shortly

Our Partners