As Crypto Goes Bullish Ethereum DeFi Continues to Heat Up

Zooming in, Ethereum’s decentralized finance (DeFi) arena — another one of the space’s biggest sectors — has been contributing to, and reflexively thriving from, these increasingly bullish conditions in a big way lately.

For proof, let’s look at the numbers

The bitcoin price breached $17,000 USD for the first time in years. PayPal just opened up cryptocurrency services to all its U.S. customers. The Ethereum ecosystem has been on fire this year and the Eth2 evolution is now only days away.

That’s but a taste of all the major developments happening around the cryptoeconomy right now.

DeFi Hits New TVL Record

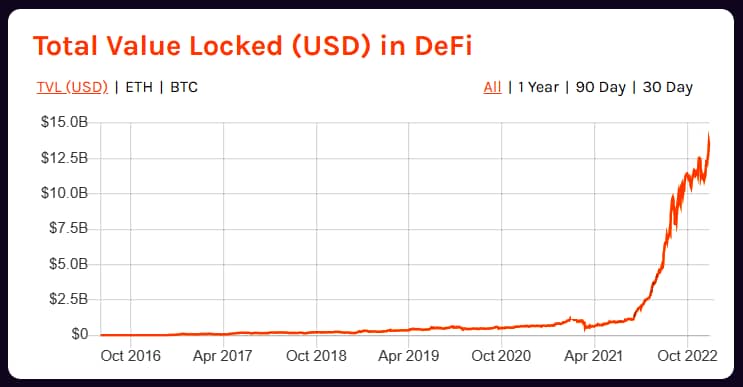

Total value locked (TVL), a metric popularized by DeFi Pulse, indicates how much crypto assets are currently under management, i.e. locked within, a given DeFi protocol or the entire DeFi ecosystem taken as a whole.

For context, the TVL of the entire DeFi economy cracked the $1 billion milestone for the first time ever back in February 2020. Then over the summer DeFi’s TVL started to go absolutely parabolic.

While there’s been chop along the way, the build up of interest and activity has proceeded up through this week, as DeFi’s TVL hit a new all-time high just over $13.58 billion on Wednesday, Nov. 11th. This means people are trusting their assets in permissionless DeFi protocols like never before.

Not long ago, there wasn’t a single DeFi dApp that had a TVL over $1 billion. Now there are five: Uniswap, Maker, WBTC, Compound, and Aave.

Uniswap, the decentralized trading protocol that’s arguably been Ethereum’s biggest star this year, has been DeFi’s biggest dApp per TVL for weeks now. Earlier this month I predicted Uniswap would hit a $10 billion TVL at some point in 2021, but that forecast is starting to look increasingly conservative as Uniswap’s already risen to ~$3 billion before the end of 2020.

In second place presently TVL-wise is Maker at $2.31 billion. DeFi’s longest-reigning lending protocol, Maker is a DeFi heavyweight because of its battle-tested infrastructure and the booming popularity of its flagship Dai stablecoin. Indeed, the market cap of Dai notably just reached $1 billion for the first time ever this week, an achievement that indicates the stablecoin is accruing significant adoption in DeFi.

Then there’s WBTC, the tokenized bitcoin project that helps folks easily put their BTC to use in Ethereum’s DeFi ecosystem, which is currently hovering right under the $2 billion TVL mark. And with the bitcoin price turning increasingly bullish lately and PayPal bringing new eyes to BTC, WBTC is extremely well positioned to keep serving as a major funnel of activity into DeFi.

Rounding out the this top 5 are money market protocols Compound and Aave, which respectively have TVLs of $1.39 billion and $1.13 at the moment. While distinct in design, both projects have seen impressive growth this year as among DeFi’s most respected trailblazers.

As time goes on, it won’t be surprising to see the round psychological milestone that is a $1 billion TVL (which is such a milestone for now precisely because it once seemed so far away) become less and less impressive as DeFi grows and more and more protocols readily cross that line in short order. Already this week there are two more projects knocking on the $1 billion club’s door, Harvest Finance ($900 million) and Curve ($850 million).

Looking ahead then, as things are lining up the DeFi space in general seems like an unstoppable force for the foreseeable future. Why? DeFi’s still super young and projects are starting to hit product-market fits for the first time ever. That means the upside could lead all the way into the heart of the mainstream.

Corporations like PayPal will gradually turn into UIs for accessing DeFi.